Contents

- How to use this guide

- How does MeasureOne work?

- MeasureOne products, solutions, and services

- How can your business get started with MeasureOne?

- Check out more resources for future and current customers:

The ability for businesses to access consumer data easily is crucial for businesses to thrive. With MeasureOne’s consumer-permissioned data (CPD) platform, you have access to a comprehensive suite of tools designed to simplify and streamline the data collection and verification process. This article will walk you through MeasureOne's products and solutions and demonstrate how to make the most of our intuitive dashboard, empowering you to gather valuable insights and make informed decisions to propel your business forward.

How to use this guide

The how-to-guide we have prepared is specifically tailored to businesses seeking to access, synthesize, verify, and leverage consumer data more effectively. MeasureOne's powerful CPD platform offers a range of products that grant you access to various types of consumer data, including insurance, employment, education, income, and brokerage information.

Whether you are an employer that needs to verify insurance coverage for your gig workers, a financial institution verifying income and employment details to approve a loan, or a background screening agency verifying an applicant's employment or education credentials, MeasureOne's solutions have you covered.

Use this guide to explore MeasureOne’s consumer data possibilities and unlock the full potential of consumer data for your business's success.

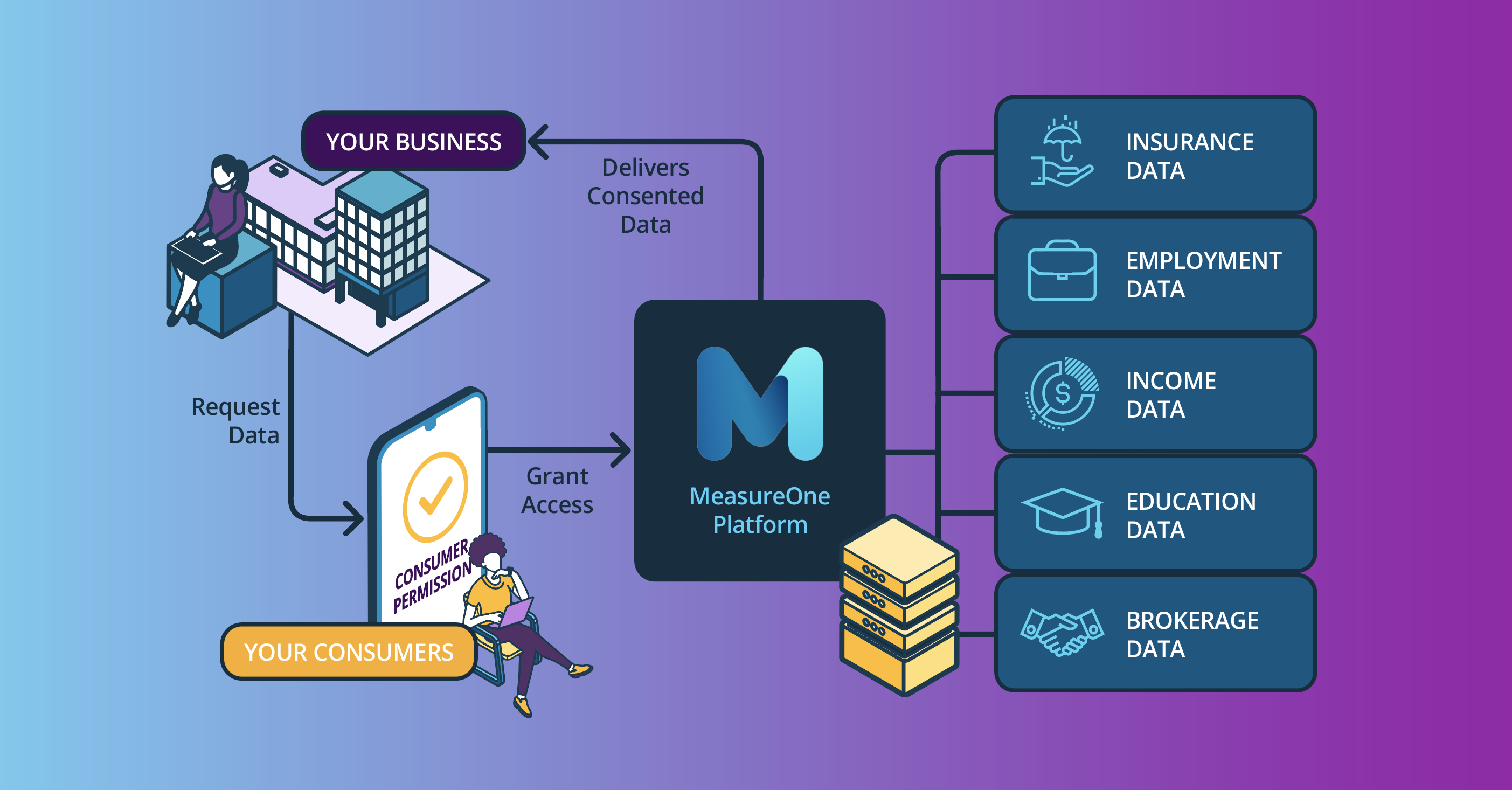

How does MeasureOne work?

Using consumer-permissioned data

Consumer-permissioned data uses credentialed data to gain access to any necessary consumer information found in an online account. It also introduces a new relationship between the consumer, the requesting business, and their data. By working with a consumer-permissioned data platform, like MeasureOne, the consumer provides secure access to their data, but consents to sharing ONLY the necessary information with the requesting business.

The platform plays two roles in the transaction: (1) it ensures that only the permissioned information is shared with the requesting business, and (2) it guarantees the provenance of the data to the requesting business.

By using a consumer-permissioned data model, the consumer maintains control over their data. They can safely and securely share their information, knowing that only the necessary, specifically-requested information is disclosed to the requesting business.

Using consumer-permissioned data is beneficial for the requesting business too. When they take advantage of CPD, businesses get:

- Access to any consumer data in an online account including income, employment, education, insurance, brokerage data, and more

- Real-time data from primary sources ensuring 100% accurate and up-to-date data

- Automation of traditionally manual data collection processes

Using document uploads and automated processing

For consumers who do not have access to an online account for a business’ data request or who have their documentation on hand, fraud-proof document processing is supported and enhanced by MeasureOne. In fact, MeasureOne’s document processing product is 100% accurate as a fall-back or even primary solution for businesses to take advantage of.

How it works:

- A consumer uploads a .pdf, .png or any supported image type of the requested documents (e.g. paystub, insurance policy, academic transcript)

- We do the rest by consolidating the information gathered from both structured and unstructured documents into a precise report.

- You get the data you need, processed directly from a user's uploaded documents.

MeasureOne products, solutions, and services

Gather the consumer data you need for various use cases. MeasureOne has created the industry’s first consumer-permissioned data platform-as-a-service, covering a wide range of data types including education, income, employment, insurance, brokerage, and the potential to do much more. Here’s our current collection of data types and their various use-cases we’ve seen so far:

Data types we support

Insurance Data: Collect insurance data to instantly verify insurance coverage, enhance underwriting sets, and enable greater personalization and digital distribution. Data includes: Home insurance policy, auto insurance policy, total premium, payment schedule, address of insured, VIN of insured, dates of coverage, and more.

Use cases:

- Verify insurance (home, auto, and more)

- Collect insurance coverage details

Customers using insurance data:

- Insurance agents

- Credit unions

- Employers

- Lenders

Employment Data: Collect consumer employment information directly from a payroll account to verify current employment including: Employer name and address, hire date, job title, termination/end date, and more.

Use cases:

Customers using employment data:

- Credit unions

- Employers

- Lenders

- Consumer reporting agencies

- Property managers

Income Data: Collect consumer income information directly from a payroll account for up to the minute accurate income data including: Gross and net pay, gig worker 1099 compensation, full pay and earning statement information, and more.

Use cases:

Customers using income data:

- Credit unions

- Employers

- Lenders

- Property managers

Education Data: Collect education information directly from an online school account including: Dates attended, transcripts, degrees, credit information, and more.

Use cases:

Customers using education data:

- Consumer reporting agencies

- Collegiate esports organizations

Brokerage Data: Collect tax form and schedule data directly from a consumer’s online brokerage account including: 1099-B, 1099-C, 1099-DIV, and many more.

Use cases:

- Tax preparation

- Asset verification

Customers using brokerage data:

- Tax prep services

- Lenders

How can your business get started with MeasureOne?

MeasureOne offers consumer-permissioned data solutions at all levels of integration.

Hosted portal and dashboard

No development involved. When you sign up with MeasureOne, you get access to the MeasureOne self-serve dashboard, which allows you to add users, send data requests, receive the consumer-permissioned data you need, and more, all within the dashboard. Your users will receive an email or text invite link and be directed to MeasureOne’s optimized hosted portal to complete the data request.

When you sign up, your business gets 30 days free to use the dashboard and send data requests.

Using 3rd Party Platforms

MeasureOne is integrated with third party platforms MeridianLink, TazWorks, Accio Data, and more, allowing for easier integration and deployment using your existing operational workflow. Users connected with either third party platform can send data requests and receive the requested data directly through those partner platforms.

Connecting via API

To get started using MeasureOne’s API integration within your existing workflow or application, you’ll need our API keys.

Our APIs deliver data over webhooks that you subscribe to when you create a data request. From there, our widget (which can be customized to your branding) can be embedded into your existing workflow for a native experience.

For instant access to consumer-permissioned data and document processing, MeasureOne is here for your business needs. Ready to get started?

Check out more resources for future and current customers:

- Frequently asked questions about MeasureOne and our products

- Customer stories and case studies from current customers

- Dashboard Help Center with guides and walkthroughs of our self-serve dashboard

- Blog to read up on current and future use cases

- Demo videos to see the various user experiences