98% coverage of US and Canada colleges and universities

Instant Education Verification API

Effortlessly check education history. Access and verify education data for 99% of US, Canada, UK, and India higher education institutions.

Skip the hassle of conducting education checks across multiple institutions with MeasureOne's one-stop-shop

Lower your costs with faster, reliable education verification that doesn't involve the National Student Clearinghouse

Make informed decisions with the data you need to verify applicant education history

Benefits of Education Verification with MeasureOne

Unmatched Completion Rates

Unique data source waterfall ensures verification of applicants with and without school credentials

Faster processing times

Verify education in seconds

Competitive Pricing

A lower-cost alternative to The National Student Clearinghouse

Easy Set-up

We offer flexible deployment options to fit your business needs

Data you want

Broader data access than current market solutions

Consumer privacy guarantee

All data is shared with the consumer's permission

Extensible platform

Easily expand into new geographies, data types, and more

Grow your business

Reduce your costs and streamline your processes

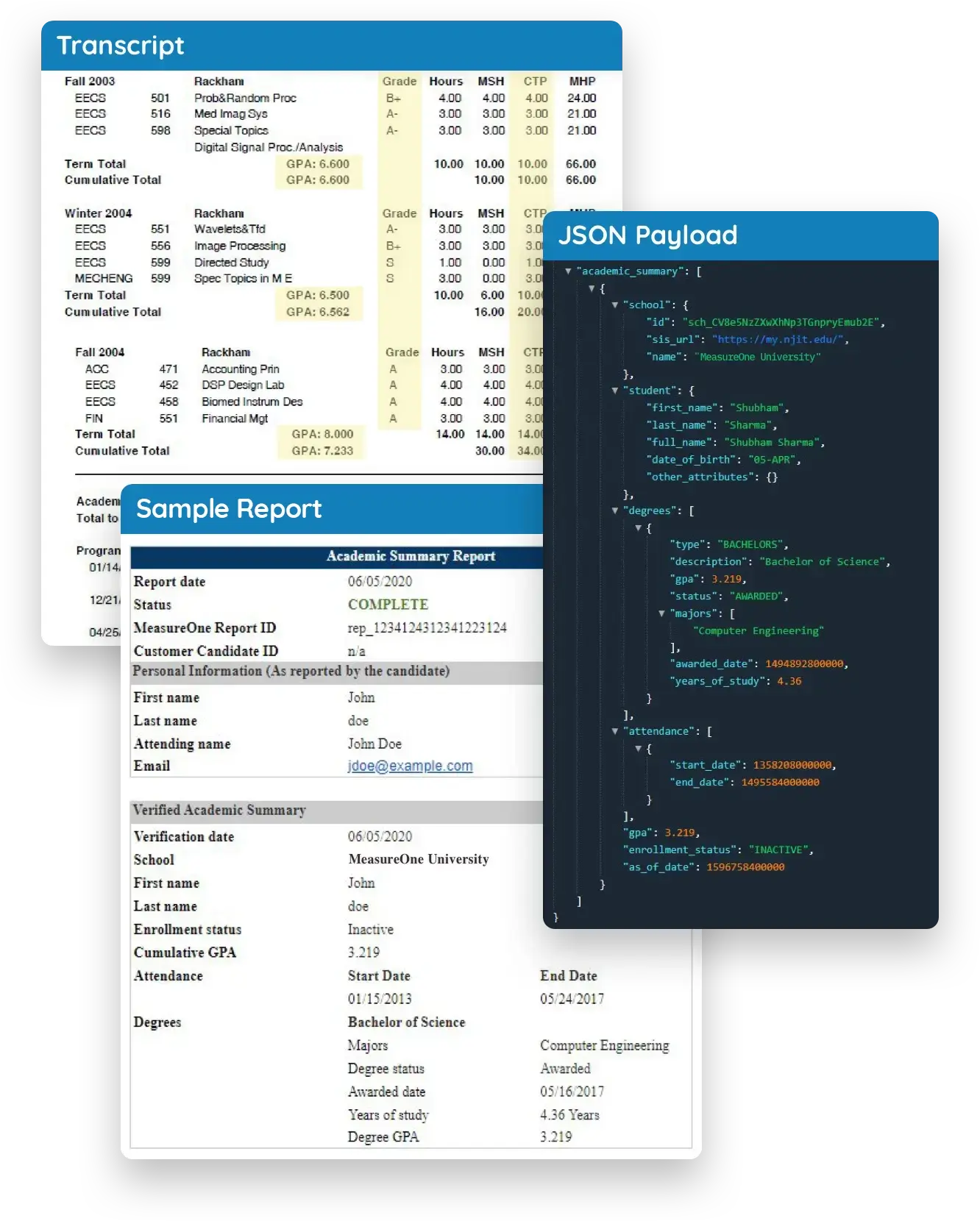

Deterministic Document Processing With AI

Get best-in-class document parsing and processing with an optimal combination of deterministic doc processing and AI

99%

Coverage of US, Canada, UK, and India Higher Education

117,000+

Data Sources

Getting Started is Easy

From small business to enterprise, integration solutions for everybody

MeasureOne Dashboard

No-code required to request, access, and verify the data you need in one centralized location

3rd Party Platforms

MeasureOne integrates with third party platforms allowing for easier integration and deployment using your existing operational workflow

API

Integrate the consumer experience natively into your application. Results will automatically populate your platform

Flexible Reporting Options

Reports are 100% configurable to your business needs

Get any data from a user's online school account

Access real-time, up to date data with the highest level of accuracy directly from a user's online school account

Degrees completed

Dates of attendance with graduation dates

Academic Majors with GPA

Other transcript information available upon request

Markets Using Education Verification

Get accurate and cost-effective education verification to grow your business

Ready to automate?

Let us show you a better way to access and verify consumer data for your business.