Integrate once with MeasureOne's API and access any data that lives in consumers’ online accounts for any verification needs.

Gig Economy Companies

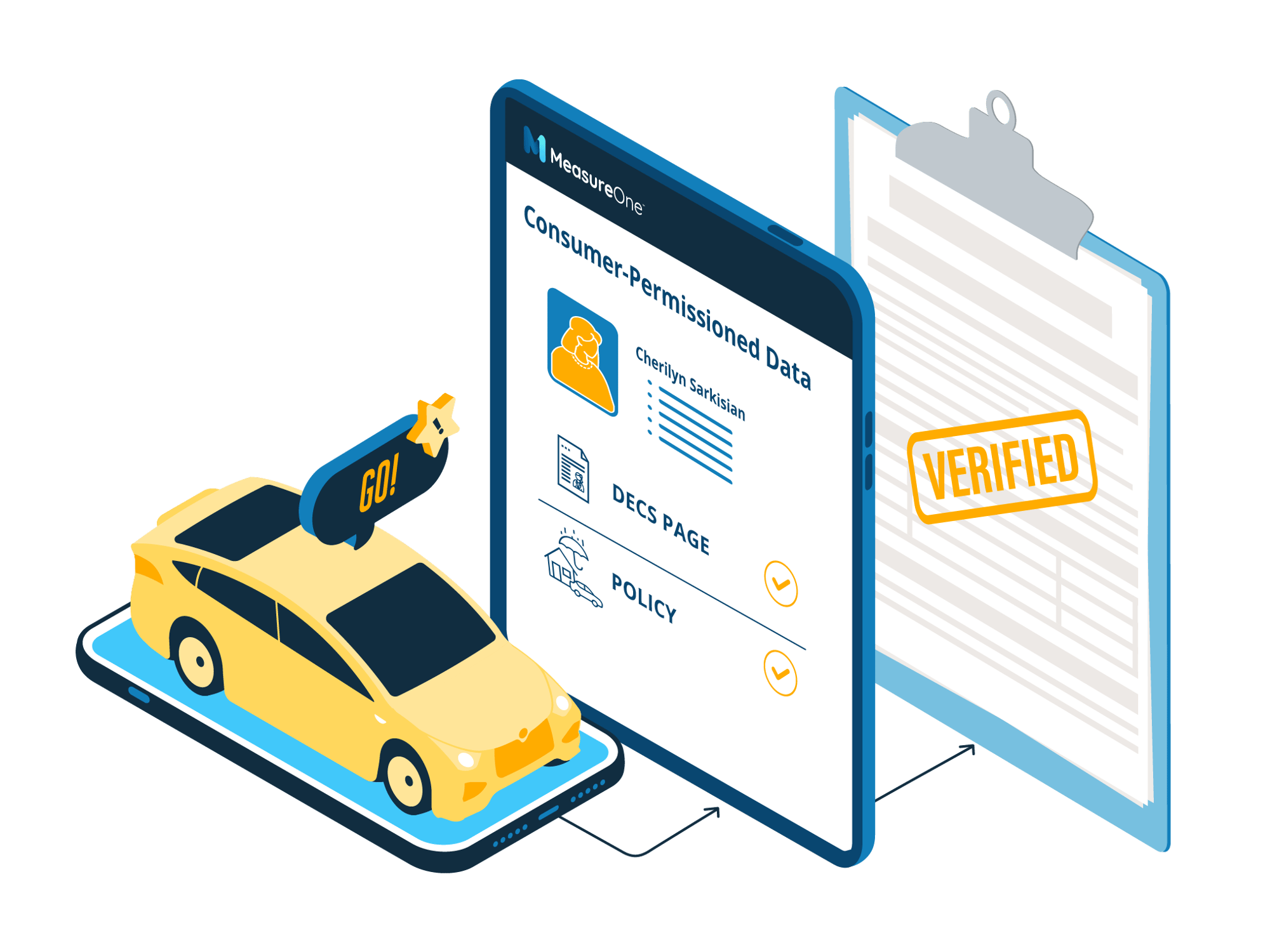

Collect gig worker insurance data instantly and on a recurring basis to lower your risk

Verify auto or other insurance coverage for any gig worker you hire

Lower your risk by ensuring your gig employees have the appropriate insurance coverage in place at all times

Enhance the gig worker onboarding experience and lower your costs by leveraging the MeasureOne API

Instant Insurance Data Collection for Gig Economy Companies

A powerful platform

Single, easy applicant experience

Verify employee insurance coverage, including auto insurance verification, with one consistent UX

Full Automation

A fully automated verification experience means faster processing and fewer errors when when verifying insurance coverage for your employees

Superior market coverage

95% of all major auto insurance carriers, 100% support for all major insurance providers, and more than 2.7 million documents processed

Consumer privacy guarantee

All data consumer approved

Document Processing

Proprietary, automated, and determinisitic document processing combined with AI for 100% accuracy

Top solutions for the Gig Economy Companies

Auto Insurance Verification

Instantly collect, verify, and re-verify up-to-date auto insurance data including policy number, dates of coverage, and more.

Insurance Coverage Details Collection

Use our API to pull employees' info for as-needed coverage details collection

Document

Processing

Proprietary, automated, deterministic document and image processing with 100% accuracy

Gig Economy Company Use Cases

We power any insurance verification you need to lower your risk and enhance gig worker onboarding

Auto Insurance Verification for Gig Workers

MeasureOne provides a streamlined process for verifying proof of auto insurance for gig workers. While using consumer-permissioned data, MeasureOne can streamline your current insurance verification processes. Instead of users having to manually provide proof of auto insurance, now they can log directly into their online insurance account to give you access to their auto insurance data.

This new method of providing auto loan insurance verification is a faster, safer & easier way to underwrite car loans. To provide a win-win to you and your car loan applicants, get a demo today.

Document Processing for Gig Companies

Our document processing product allows consumers to upload any structured or unstructured image or document for your business needs. The document is processed with 100% accuracy, pulling the requested data you need instantly. Contact us to learn about all of the current capabilities of our document processing product and how we can improve your current systems. With the ability to access auto insurance data via document upload, MeasureOne can improve your current onboarding platform. Get a demo today.

Customized Request for Data

MeasureOne’s consumer-permissioned data platform can be customized to pull verified data from any online consumer account. Have something new in mind that isn’t appearing above? Contact us today and talk to one of our expert team members about any custom data verification request you may have.

Getting Started is Easy

From small business to enterprise, integration solutions for everybody

MeasureOne Dashboard

No-code required to request, access, and verify the data you need in one centralized location

3rd Party Platforms

MeasureOne integrates with third party platforms allowing for easier integration and deployment using your existing operational workflow with recurring and one-time data access

API

Integrate the consumer experience natively into your application. Results will automatically populate your platform

Gig Economy Customers

Trusted by 100+ brands, MeasureOne is the leading platform for instant access to and verification of consumer data for the automotive market.

“Using MeasureOne has allowed us to accurately verify income for our members in a shorter time-frame than ever before.Plus, the MeasureOne team is so helpful and always enthusiastic when we provide feedback.”

Ready to automate?

Let us show you a better way to access and verify consumer data for your business