Access Granted: The MeasureOne Podcast

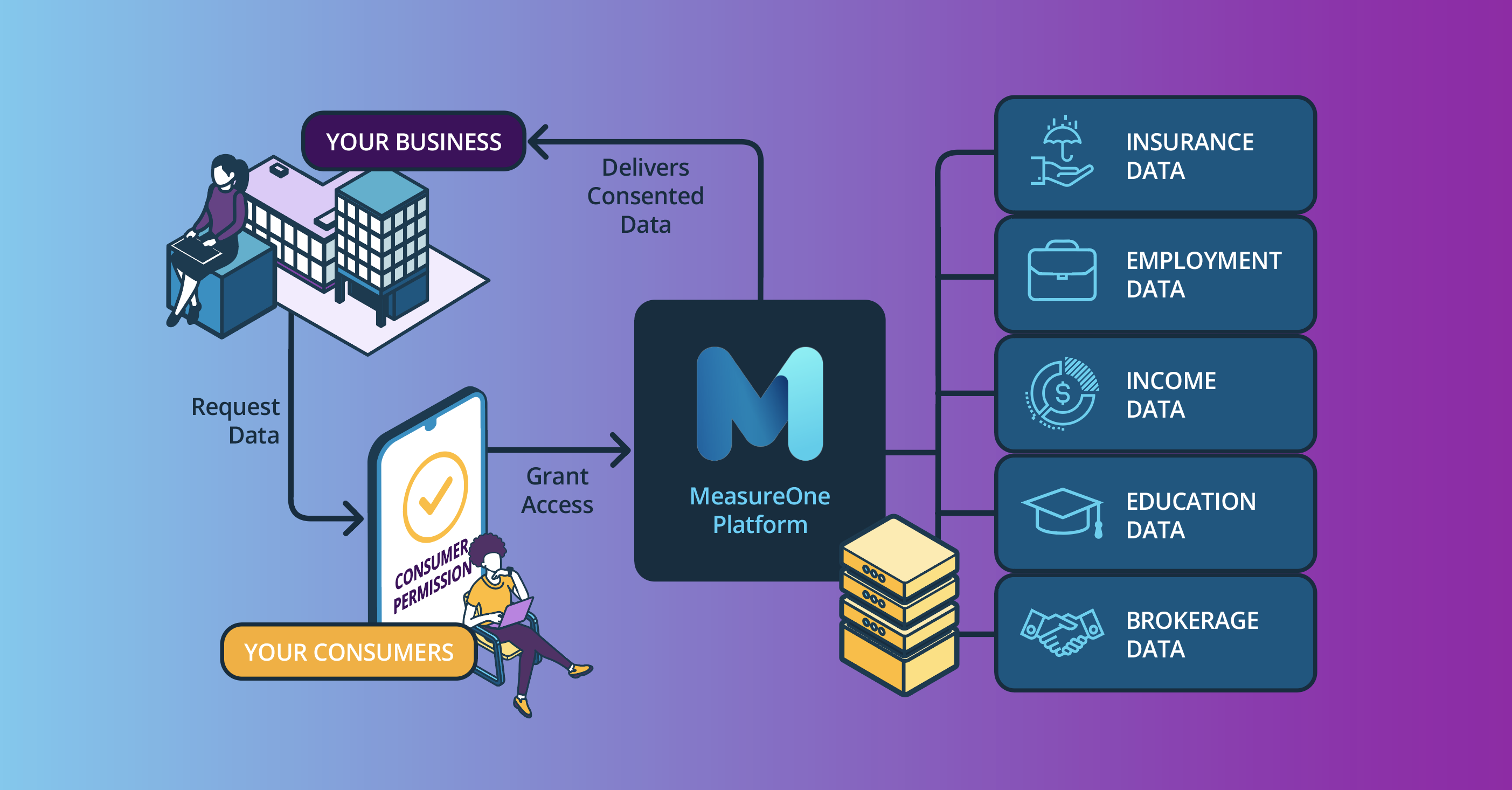

Your go-to podcast, powered by AI, for deep dives into the world of data access and verification. Explore the latest trends, technologies, and challenges in industries that rely on consumer-permissioned data, ranging from auto dealerships to tax preparation, lending, education, and more.

Subscribe now to get the latest podcasts straight to your inbox!

Episodes

Online car sales are growing and traditional dealerships can easily adapt to this market. Hear about the benefits of online car buying platforms for both consumers and dealerships, especially the role automation plays in enhancing the buying experience.

Between eager buyers, end-of-year incentives, and the allure of new models, the winter season is a prime time for car sales. But with the surge in demand comes the challenge of managing increased foot traffic, increased online search and sales, high volumes of transactions, and the need for streamlined processes.

What are the potential benefits and risks associated with using AI in business operations? Hear all about the value of AI in streamlining processes, enhancing efficiency, and enabling faster decision-making but learn also about AI's potential for discrimination, misinformation, and undermining trust.

Listen to an explanation of how AI and automated systems can enhance personal injury claims processing for law firms, and dig into the importance of easy access to claims history data.

State mandates are increasing the need for dealerships and lenders to verify insurance before registering vehicles, highlighting the benefits of automated verification, which can streamline the process and reduce administrative burdens.

Hear all about challenges auto dealerships face during the car financing process, specifically related to manual data verification, customer expectations, compliance, and outdated dealership management systems (DMS). Plus, get insight on the solutions!

Automation allows dealerships to efficiently and accurately assess customer financial standing and ensure they have the necessary insurance coverage, ultimately leading to faster and more secure transactions. Hear how automated auto insurance from MeasureOne takes it to the next level

Auto financing is evolving in 2024 and 2025—hear about how its affected by economic, consumer, and technological trends. Learn about the growing adoption of technology in loan processing, including AI and automation, and the importance of integrating insurance verification systems.

Listen to the podcast that shares importance of verifying auto insurance before test drives at car dealerships, and how the practice safeguards both dealerships and customers from potential financial and legal risks. Automation, especially that from MeasureOne, offers a quick and secure way to verify insurance, streamlining the process for dealerships and improving the overall customer experience.

What's the risk of a borrower's lack or lapse in auto insurance? Hear about the reasons why car insurance may lapse, the legal and financial consequences for borrowers, and the risks associated with lapsed insurance for lenders and dealerships. Plus, you'll learn about the challenges of manually monitoring car insurance coverage and the benefits of automated insurance monitoring solutions.

Get insights on how to improve your car rental processes by automating the verification of customer insurance data, streamlining the rental process and ensuring compliance with insurance requirements. By integrating automated technology, car rental agencies can save time and money, improve customer experiences, and reduce risks associated with uninsured drivers.

Take a deep dive into AI. While AI can improve efficiency, it is not a complete solution due to its dependence on high-quality data, lack of context, and inability to adapt to novel situations. Hear how to overcome these limitations using a combined approach that integrates AI with deterministic parsing technology to ensure accurate and reliable data processing.

Hear all about how to choose the right auto insurance verification solution provider for your business. Learn about the features to look for including consumer-permissioned data verification, document processing, and claims history access, all of which ensure compliance with regulations while mitigating potential liabilities.

Why should car rental companies take advantage of automation? Take a listen about the rental car use-case for automated auto insurance verification and how it can be used to verify renters' auto insurance quickly and efficiently, ensuring compliance with regulations, protecting assets, and mitigating liability.

Our inaugural podcast! Listen in on a discussion on the difference between credentialed and non-credentialed data for businesses. Credentialed data is obtained directly from consumers through their online accounts, while non-credentialed data is gathered from third-party sources such as credit bureaus or public records. Hear about the advantages of using credentialed data, including its accuracy, transparency, and cost-effectiveness

Ready to get started?

Let us show you the value of consumer-permissed data for your business