Integrate once with MeasureOne's API and access any data that lives in consumers’ online accounts for any verification needs. The all-in-one automated platform means faster processing, reduced errors, and more conversions. Streamline your processes and grow your business.

Fraud-proof tenant verification

Instant, automated tenant checks—from renters insurance to income and employment verification—so you can lease smarter and safeguard your investments.

Transform the applicant experience with automated verification of income and employment

Verify and monitor renters insurance coverage in minutes

Leverage real-time consumer data to accelerate the tenant approval process

Enhance the tenant screening process with fraud-proof bank transaction-based income verification for tenants with non-traditional work

Instant Tenant Verification

A FULLY AUTOMATED POWERFUL PLATFORM

EXTENSIVE COVERAGE FOR YOUR TENANTS

Verify income, employment, and renters insurance for all tenants, including non-traditional contract workers, freelancers, and more, with support for both payroll-based and bank-based income verification via API along with fraud-proof document processing.

SIMPLE SET UP WITH COMPETITIVE PRICING

Flexible deployment options to fit your business needs, and a lower-cost alternative to legacy providers enables you to take advantage of an automated verification solution without disrupting your workflows or making compromises.

AUTOMATED DOCUMENT PROCESSING

Get an optimal combination of deterministic parsing and AI for 100% accuracy. Seamlessly integrate automated document processing in partnership with MeasureOne’s credentialed solution for higher completion rates. In the case that the user doesn’t have an online account (or has trouble connecting to it), they can upload their documents and we’ll process them.

Top solutions for property management

Income and Employment Verification

Gain real-time, direct verification of a consumer’s income and employment data via API.

Renters Insurance Verification

Access and verify renters insurance data for lease approvals, risk management, and compliance

Insurance Monitoring

Monitor policy status in real-time. Stop chasing renewals and expired policies.

Document

Processing

Proprietary, automated, deterministic document and image processing with 100% accuracy

How Tenant Verification Works with MeasureOne

1

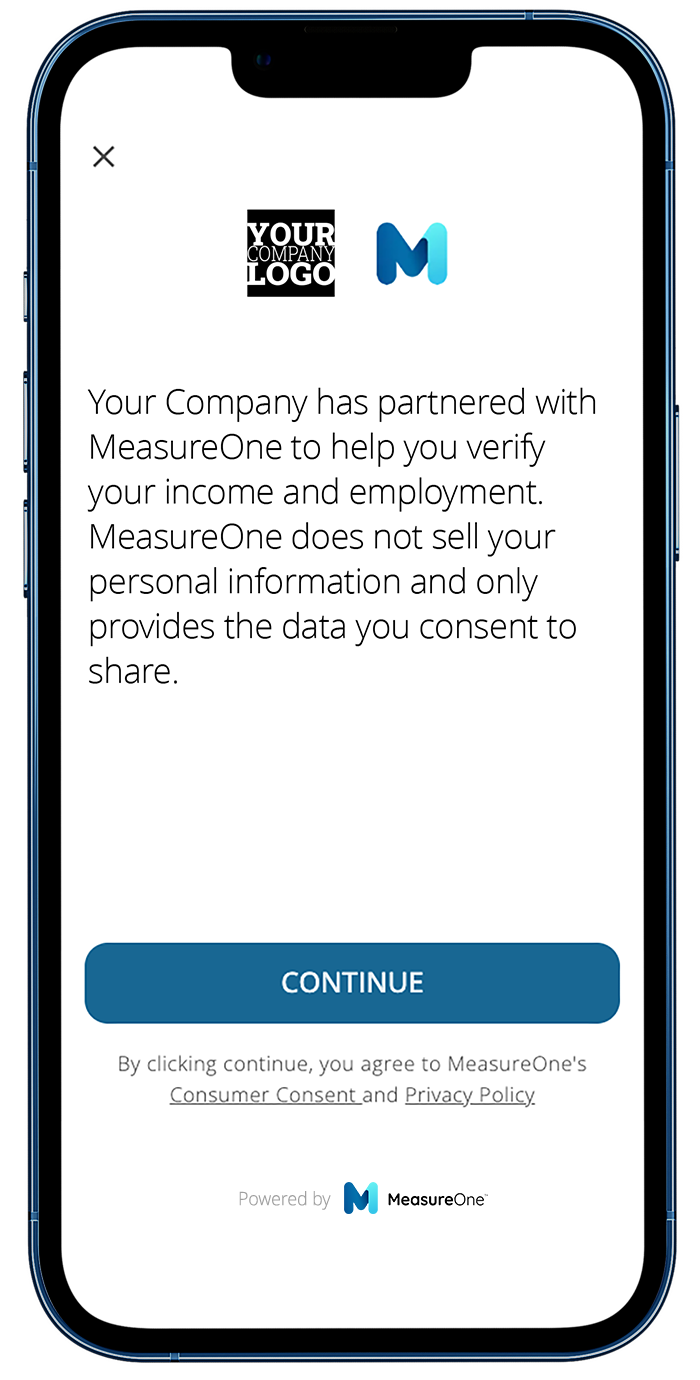

The tenant applicant gives permission to MeasureOne to access their data for the specific purpose(s) of the requesting business (e.g. income verification by a property manager)

2

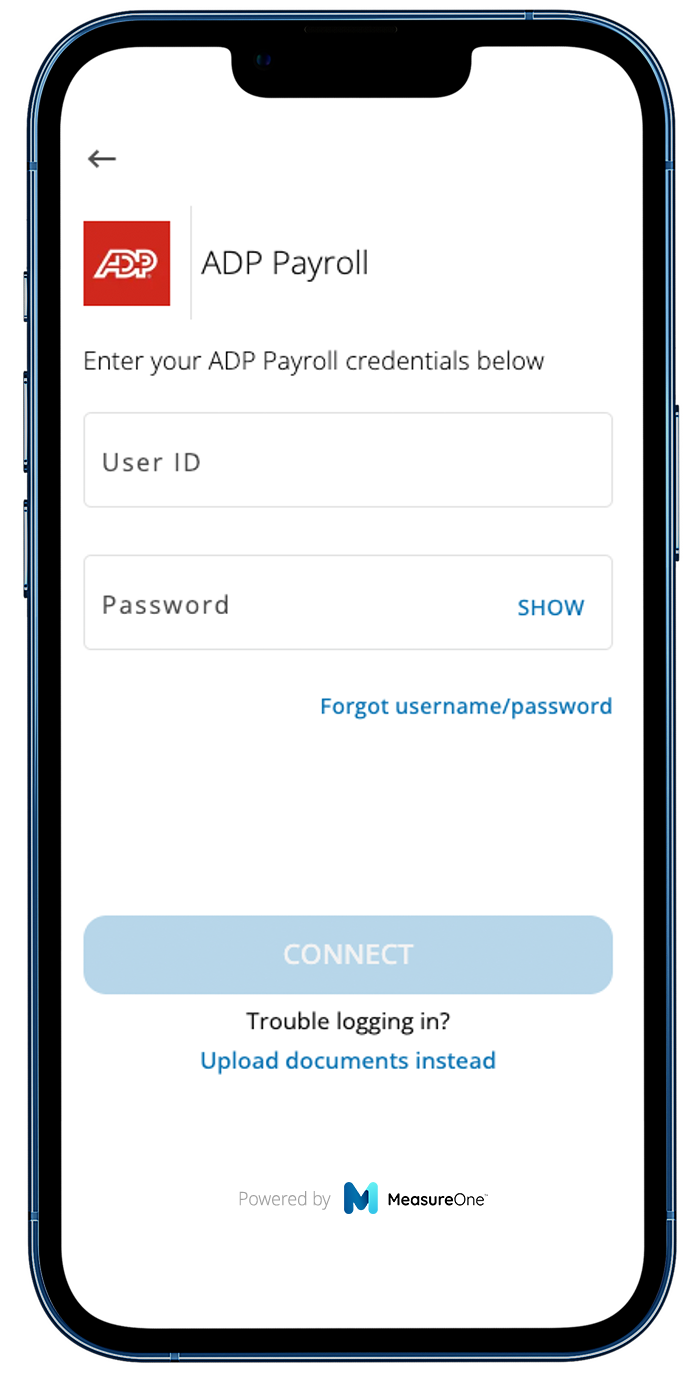

The tenant logs into their online payroll account or insurance account within the MeasureOne platform to connect their source data

2a

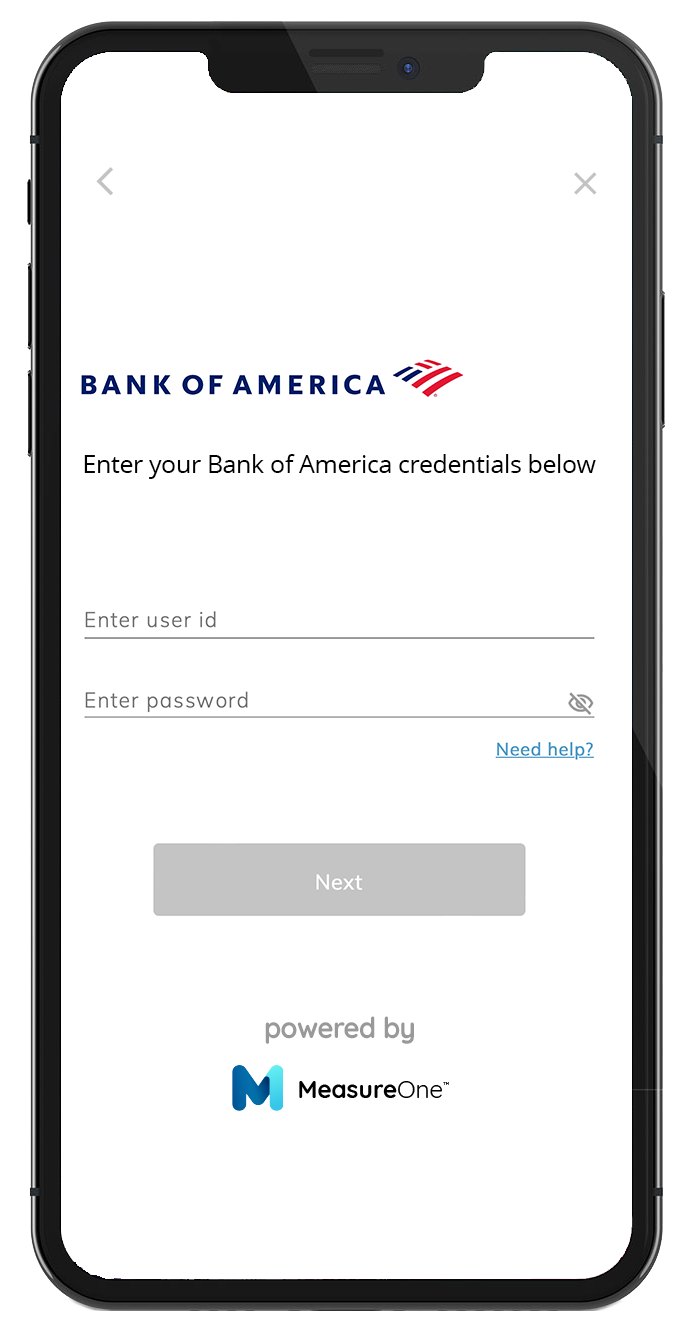

For tenants without a payroll account, they connect to their bank account within the MeasureOne platform to verify income against transaction history

2b

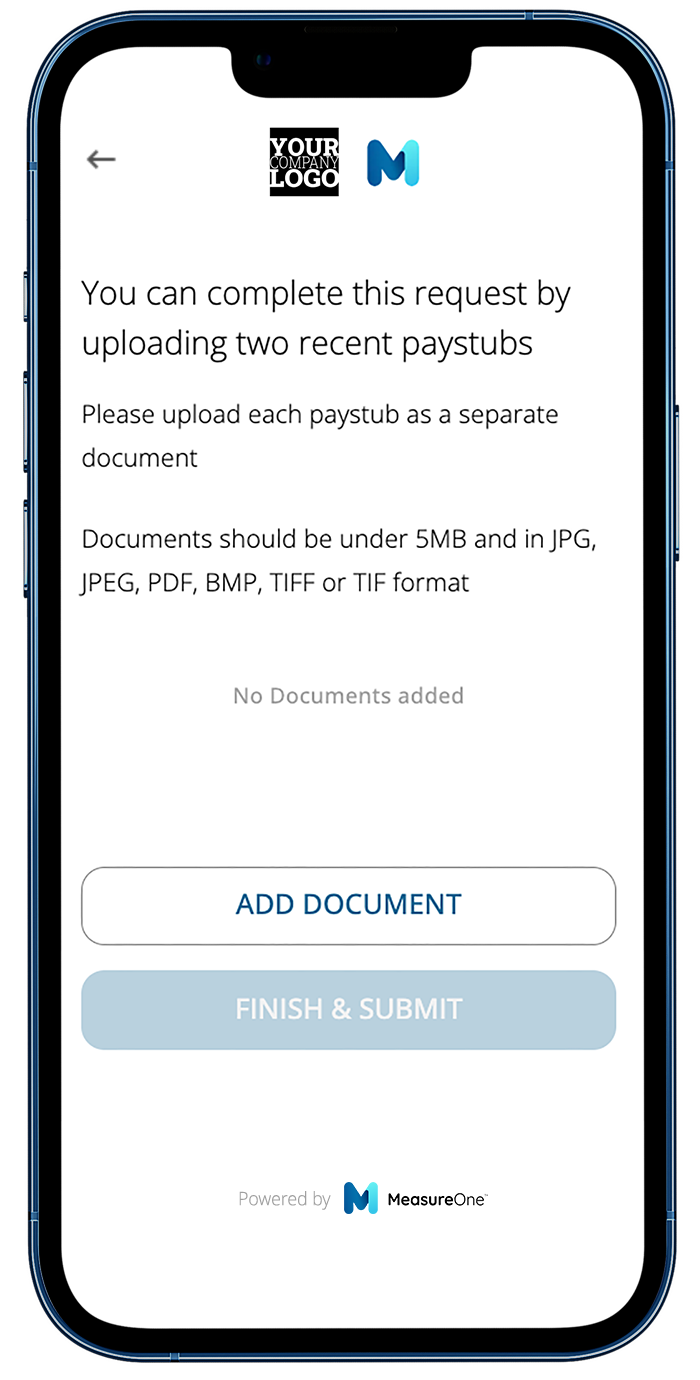

MeasureOne provides an alternative option to income verification by enabling the consumer to upload recent paystubs and verify that data against bank deposits. For employment verification, the consumer can upload their EDR report.

3

Success! The consented and verified income and employment data is instantly delivered back to the property management company.

Which solutions do most landlords use?

Landlords typically use background screening solutions to help evaluate potential tenants for credit checks, criminal history checks, rental history, and income and employment verification.

At MeasureOne, property managers use employment and income verification solutions to evaluate a tenant's ability to pay rent and to even combat tenant fraud. MeasureOne verifies an applicant’s employment by connecting directly to their payroll account and an applicants income via their payroll account or bank account. If for whatever reason the applicant cannot connect to their accounts, MeasureOne verifies their information by processing documents that show their income, such as pay stubs or tax returns using MeasureOne’s document processing solution, which allows for proprietary, automated, deterministic document and image processing with 100% accuracy. Document processing is an effective alternative for tenants who do not have access to an online payroll system.

What if the tenant doesn't remember their login credentials?

We provide a direct link to the exact webpage on the account website to recover/reset login credentials.

Is income and employment verification from MeasureOne fraud-proof?

Yes! By connecting directly to a tenant's payroll and/or bank account and verifying income and employment data, we eliminate the risk of fraudulent submissions, ensuring the accuracy and reliability of the income and employmentdata. Rest assured, every verification is backed by direct access to the primary source–payroll and bank accounts.

Are tenants comfortable sharing their credentials?

We are seeing near 100% participation in the process. There is also a strong precedent for consumers sharing access to much more sensitive data in return for some benefit to them.

What happens if the tenant never completes the process?

Best practice with our customers is to use MeasureOne as the primary solution. If for whatever reason, a consumer is unable to connect to their online account, they have the ability to upload the requested documentation for us to process and provide the data directly to you.

If for whatever reason the consumer still fails to complete the process, we recommend falling back to your current solution after a defined time frame.

Does MeasureOne have a support team for tenants?

Yes! Our support team is available 24/7 to answer consumer questions.

Can I white-label your service?

Yes! For more information, schedule a demo.

How to run a background screen on a tenant?

The process of running a background check on a potential tenant is simple:

- After obtaining written consent from the tenant (typically by including it in the rental application), landlords and property managers will select a screening provider. Screening providers can include specialized tenant screening companies, general background check companies, and consumer-permissioned data platforms like MeasureOne.

- Landlord/management company will choose the type of screening they need. This can include credit checks, criminal history checks, rental history checks, employment and income verification, and reference checks.

- Landlord/property manager will provide tenant information, such as their full name, date of birth, and social security number, to the screening provider. For income and employment verification with MeasureOne, property managers and landlords will simply provide the tenant email address and/or phone number to send a request for the tenant to log into their payroll account to pull their income and employment data. See how it works.

- Once the data is received, it’s time to review the report. Data is compiled instantly into a report for easy access to verify tenant information.

More from the Blog

Streamlining renters insurance verification with MeasureOne

Kristin Allton, MeasureOne Mar 25, 2025Why property managers need automated renters insurance

Kristin Allton, MeasureOne Feb 12, 2025Customers

Trusted by 100+ CRAs, MeasureOne is the leading consumer-permissioned data platform for tenant screening

“Secure, simple and a big savings for our clients. MeasureOne has changed the game for degree verifications. Their consumer-permissioned data platform provides our clients’ applicants a user friendly experience; expediting the verification, and delivering accurate results.”

Ready to automate?

Let us show you a better way to access and verify consumer data for your business