Expand opportunities to young, thin-file consumers with high lifetime customer value

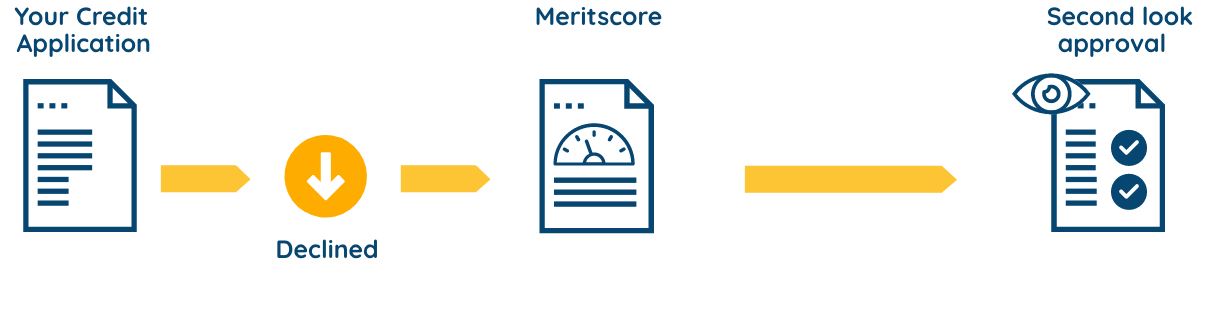

Use our highly predictive academic data to drive more informed decisions, resulting in reduced risk and fewer defaults

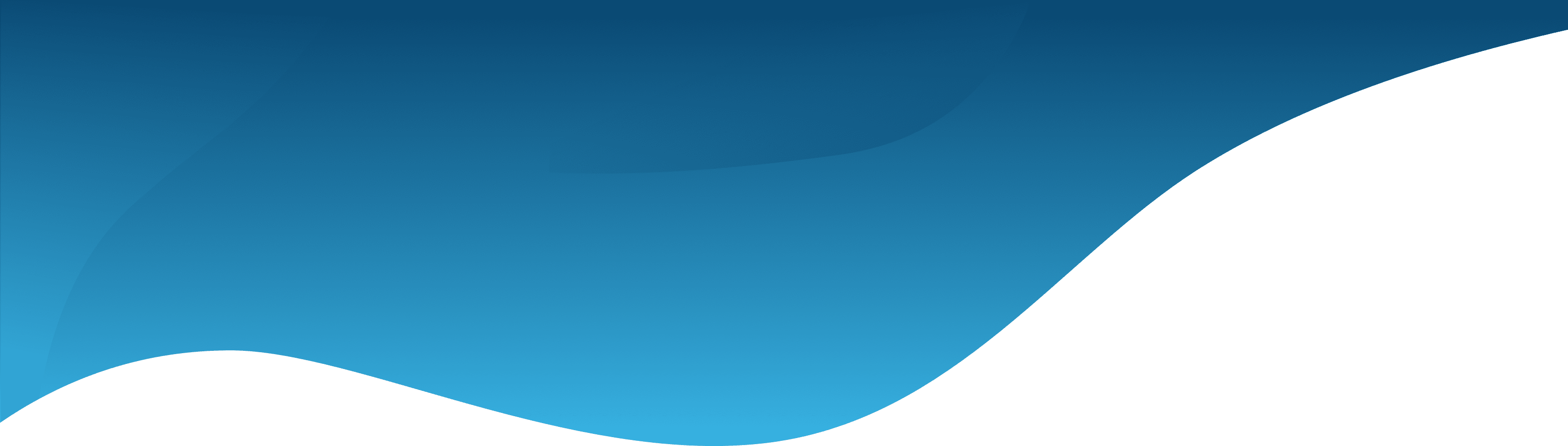

Swap-In/Second Look Lending

Swap-Out Lending

Credit measure for mortgages

Credit measure for rentals

Alternative credit measure